The RNA Revolution Accelerates: Pharmaceutical and Biotechnology Giants Invest Billions in Next-Generation Therapies

Authors: Yassine El Bakkouri, Xavier Linker, Alexandre Morizot

In 2025, RNA technologies are triggering a true investment race. Over the past year, Bristol Myers Squibb spent USD 1.5 billion to acquire Orbital Therapeutics. Novartis committed up to USD 2.2 billion to the development of an siRNA-based therapy designed by Arrowhead Pharmaceuticals. Novo Nordisk, for its part, is betting on an RNA-based approach to treat obesity and diabetes through a partnership valued at USD 550 million with Replicate Bioscience. And this is only a snapshot: in 2025, deals involving RNA technologies have been multiplying almost weekly.

I. 2025: The RNA Gold Rush

When Bristol Myers Squibb announced the acquisition of Orbital Therapeutics, it was not merely another biotechnology deal, but a clear signal: RNA technologies have now become a major strategic priority for pharmaceutical and biotechnology giants.

Bristol Myers Squibb is not alone in this move. Investments now reach tens of billions of dollars. Novartis stands out as a leader, with four major transactions totaling nearly USD 20 billion. The group covers multiple therapeutic areas (neuromuscular disorders, renal and cardiovascular diseases) and diversifies its portfolio across several RNA classes (siRNA, microRNA, AOC), establishing itself as a major player in therapeutic RNA in 2025 (Tables 1 and 2). Eli Lilly is deploying a comparable strategy: four agreements and one acquisition worth more than USD 5 billion, focused primarily on metabolic diseases. The company notably leverages artificial intelligence to design oligonucleotides, capitalizing on its longstanding expertise in diabetes and obesity (Tables 1 and 2). These two giants are joined by AbbVie, Biogen, BioNTech, Etherna, Daiichi Sankyo, Merck KGaA, and Novo Nordisk, all of which are also multiplying strategic partnerships in this field.

The year 2025 marks a turning point for RNA-based therapies. While mRNA vaccines against COVID-19 and small interfering RNA (siRNA) treatments have demonstrated the viability and effectiveness of these approaches at a global scale, pharmaceutical and biotechnology industries are now committing tens of billions of dollars to extend this technology far beyond vaccines. Cancer, metabolic diseases, autoimmune disorders, neurological conditions, rare diseases; every therapeutic area is concerned. Industry leaders are no longer cautiously observing from the sidelines. They are investing heavily based on a shared conviction: RNA technologies are not merely an incremental innovation, but a complete redefinition of the drug development paradigm.

This momentum raises fundamental questions. Are we witnessing the emergence of a new therapeutic era comparable to the advent of monoclonal antibodies in the 1990s? Which diseases will benefit from these revolutionary treatments? And, above all, how will this RNA gold rush transform access to care and the competitive landscape of the pharmaceutical and biotechnology industries? To address some of these questions, it is essential to examine the strategies deployed by major players, the technologies they are acquiring, and the therapeutic areas they are targeting. In this article, we analyze the strategies of key players identified in 2025 based on publicly available data.

II. How Are Large Pharmaceutical and Biotechnology Companies Investing In RNA? Four Distinct Pathwaysatre voies distinctes

The growing interest in RNA technologies materializes through several main modalities: strategic partnerships with biotechnology companies, outright acquisitions of firms holding promising platforms or therapies, internal technology development, and startup financing. Each approach presents distinct advantages and reflects different corporate philosophies.

A. Strategic Collaborations: Sharing Risk, Accelerating Innovation

Strategic collaborations are the preferred investment model for large pharmaceutical and biotechnology companies in the RNA field. This model allows risk-sharing in development while enabling rapid access to cutting-edge expertise. The archetype of this approach remains the historic agreement between BioNTech and Pfizer (investors.biontech.de ↗), initiated in August 2018 to develop mRNA vaccines against influenza, and subsequently redirected in March 2020 toward the joint development of the BNT162b2 (tozinameran) COVID-19 vaccine (pfizer.com ↗). This partnership not only enabled the creation of an effective vaccine in record time but also required unprecedented industrial scale-up to ensure global supply during the pandemic. In 2016, Merck and Moderna entered into a major agreement for the joint development and commercialization of an experimental personalized cancer vaccine (merck.com ↗). Since then, other major alliances have emerged, and this trend intensified in 2025, with a proliferation of collaboration agreements.

Novartis and Eli Lilly stand out as leaders in this collaborative approach. Novartis structured two large partnerships: one with Arrowhead Pharmaceuticals for therapies targeting neuromuscular disorders, notably Parkinson’s disease, and another with Argo Biopharmaceutical in the cardiovascular field, particularly ANGPTL3 (BW-00112), an RNA interference (RNAi) treatment currently in phase 2 clinical trials for dyslipidemia (Table 1). Eli Lilly, for its part, concluded four strategic agreements covering diverse therapeutic areas: one with Olix Therapeutics for a phase I RNA therapy against metabolic steatohepatitis; an agreement with Creyon Bio for AI-designed oligonucleotides; a collaboration with Rznomics to exploit the trans-splicing ribozyme platform for hereditary hearing loss; and a final partnership with SangeneBio to expand its metabolic disease portfolio (Table 1).

During 2025, several other notable strategic collaborations were established. Novo Nordisk entered into an agreement with Replicate Bioscience to leverage self-replicating RNA technology for cardiometabolic diseases (Table 1). Merck KGaA partnered with Skyhawk Therapeutics, which will use its proprietary SkySTAR® platform to identify small-molecule candidates targeting specific RNAs designated by Merck KGaA (Table 1). Biogen invested in City Therapeutics to develop RNAi technologies for central nervous system diseases (Table 1). AbbVie partnered with ADARx Pharmaceuticals to develop next-generation siRNA therapies across neuroscience, immunology, and oncology (Table 1). Daiichi Sankyo concluded an agreement with Nosis Biosciences for RNA-based therapies targeting specific cells in chronic liver, heart, brain, lung, kidney, and muscle diseases (Table 1). Finally, Etherna signed an agreement with Dropshot Therapeutics to develop multiple new drug candidates for cardiac and renal diseases (Table 1).

Soufflé, a biotech combining proprietary technologies for cellular receptor identification, ligand optimization, and siRNA design, raised more than USD 3.5 billion through financing and partnerships. Its partners include several pharmaceutical giants: AbbVie, Amgen, Bayer, and Novo Nordisk (Table 1).

These agreements reveal a clear trend: large pharmaceutical and biotechnology companies prefer to collaborate with innovative biotechs rather than develop these complex technologies alone. This approach provides access to de-risked platforms while maintaining financial flexibility.

| Investor | Target | Amount | Key technologies | Therapeutic area | References |

| Novartis | Arrowhead Pharmaceuticals | $2.2 billions | ARO-SNCA, an antibody-oligonucleotide conjugate (AOC) | Neuromuscular disorders (Parkinson’s disease and related disorders) | ir.arrowheadpharma.com↗ |

| Novartis | Argo Biopharmaceutical | $5 billions | ANGPTL3 (BW-00112), an interfering RNA (siRNA) | Dyslipidemia (Cardiovascular disease) | argobiopharma.com ↗ |

| Eli Lilly | Creyon Bio | Up to $1 billion | Oligonucleotides designed using artificial intelligence | Several therapeutic areas (rare and common diseases) | fiercebiotech.com ↗ |

| Eli Lilly | Rznomics | Up to $1.3 billion | Trans-splicing ribozyme | Hereditary hearing loss | rznomics.com ↗ |

| Eli Lilly | Olix Therapeutics | $630 millions | OLX75016, a small interfering RNA (siRNA) | Metabolic steatohepatitis (MASH) | pharmaceutical-technology.com ↗ |

| Eli Lilly | SangeneBio | $1.2 billion | Interfering RNAs | Metabolic disease pack | sanegenebio.com ↗ |

| Novo Nordisk | Replicate Bioscience | $550 millions | Self-replicating RNA | Cardiometabolic diseases | replicatebioscience.com ↗ |

| Merck KGaA | Skyhawk Therapeutics | $2 billions | RNA modulation | Neurological disorders | skyhawktx.com ↗ |

| Biogen | City Therapeutics | Up to $1 billion | Interfering RNA | Central nervous system diseases | citytx.com ↗ |

| AbbVie | ADARx Pharmaceuticals | Undisclosed | Next-generation siRNA therapies | Several therapeutic areas (neuroscience, immunology, oncology) | news.abbvie.com ↗ |

| Daiichi Sankyo | Nosis Biosciences | Undisclosed | Targeted RNA for specific cells (liver, heart, brain, lung, kidney, muscles) | Several therapeutic areas | nosisbio.com ↗ |

| Etherna | Dropshot Therapeutics | $950 millions | Messenger RNA and lipid nanoparticles (LNP) | Heart and kidney disease | etherna.be ↗ |

| Amgen, Bayer, AbbVie, Novo Nordisk | Soufflé | $3.5 billions (includes investors) | Interfering RNA | Facio-scapulo-humeral muscular dystrophy (FSHD) and genetic cardiomyopathies | souffletx.com ↗ |

Table 1: Summary of major agreements identified for 2025

B. Acquisitions: Rapid Integration of Mature Technologies matures

Alongside collaborations, 2025 saw an acceleration in acquisitions. This strategy enables the full integration of technologies and teams.

In October 2025, Bristol Myers Squibb finalized the acquisition of Orbital Therapeutics. This strategic transaction provides Bristol Myers Squibb with OTX-201, an innovative therapy consisting of an optimized circular mRNA encoding a chimeric antigen receptor (CAR) targeting CD19, delivered via specifically targeted lipid nanoparticles (Table 2). This circular mRNA technology offers enhanced stability and prolonged protein expression compared with conventional linear mRNA constructs.

Novartis completed two major acquisitions in 2025. The first involved Regulus Therapeutics and its asset Farabursen, an oligonucleotide inhibitor of microRNA miR-17, under development for autosomal dominant polycystic kidney disease, the most common genetic cause of kidney failure worldwide (Table 2). The second acquisition, Avidity Biosciences, valued at approximately USD 12 billion, represents the largest transaction of the year in this field. It provides Novartis with a validated antibody-oligonucleotide conjugate (AOC™) platform targeting muscle tissue, as well as a promising pipeline of candidates for rare, progressive neuromuscular diseases (Table 2).

Eli Lilly acquired Verve Therapeutics in 2025, thereby securing access to VERVE-102. This therapy combines an adenine base editor with a guide RNA (gRNA) targeting the PCSK9 gene, all encapsulated within a lipid nanoparticle designed to target liver cells (Table 2).

AbbVie acquired Capstan Therapeutics, a transaction that provides AbbVie with CPTX2309, an mRNA-based immunotherapy for autoimmune diseases. This therapy consists of an anti-CD19 CAR mRNA that preferentially targets CD8-expressing cytotoxic T lymphocytes, representing a promising approach to modulate pathological autoimmune responses (Table 2).

BioNTech finalized the acquisition of CureVac through a public share exchange offer. This consolidation between two German mRNA pioneers enables BioNTech to strengthen its dominant position in mRNA vaccines while gaining access to CureVac’s proprietary technologies (Table 2).

| Investor | Target | Amount | Key technologies | Therapeutic area | References |

| Novartis | Avidity Biosciences | ~$12 billions | Validated antibody-oligonucleotide conjugate (AOC) platform | Rare progressive neuromuscular diseases | novartis.com ↗ |

| AbbVie | Capstan Therapeutics | Up to $2.1 billions | CPTX2309, mRNA + tLNP, generate CD19-specific CD8+ CAR-T cells, in vivo | Autoimmune diseases | news.abbvie.com ↗ |

| Bristol Myers Squibb | Orbital Therapeutics | $1.5 billions | OTX-201, a circular mRNA + LNP, encoding a CAR targeting CD19 for in vivo expression | Autoimmune diseases | news.bms.com ↗ |

| Novartis | Regulus Therapeutics | $800 millions | Farabursen, microRNA inhibitor oligonucleotide | Autosomal dominant polycystic kidney disease | novartis.com ↗ |

| BioNTech | CureVac | Undisclosed | mRNA platform | Experimental cancer immunotherapy | investors.biontech.de ↗ |

| Eli Lilly | Verve Therapeutics | Up to $1.3 billions | ERVE-102, an adenine base editor + guide RNA (gRNA) targeting the PCSK9 gene, both encapsulated in LNP | Cardiometabolic diseases | investor.lilly.com↗ |

Table 2: Summary of identified acquisitions for 2025

C. Internal Development

Some companies choose a third pathway: investing heavily in the development of internal capabilities.

Sanofi exemplifies this approach with the inauguration of a new biotechnology R&D center of excellence in Marcy-l’Étoile (Auvergne-Rhône-Alpes). This state-of-the-art facility brings together a comprehensive suite of technological platforms dedicated to accelerating the development of new vaccines, particularly mRNA-based vaccines. Since 2022, Sanofi has invested EUR 935 million to establish a unique and fully autonomous mRNA value chain in France, spanning from design to industrial-scale production (sanofi.com ↗). This vertical integration strategy aims to ensure technological independence while creating a European center of excellence.

Moderna, a pioneer of mRNA vaccines, continues to advance its pipeline with encouraging clinical results. The company recently reported positive phase 3 data for its seasonal influenza vaccine, confirming that the mRNA platform is successfully extending beyond COVID-19. Moderna is now developing mRNA-based therapies across multiple areas, including infectious diseases, immuno-oncology, rare diseases, and autoimmune disorders. The company plans to reinvest revenues into its oncology and rare disease programs (modernatx.com ↗).

D. Startup Financing

Startup financing is also a major investment vector. Several promising startups raised substantial funding in 2025. Strand Therapeutics closed a USD 153 million Series B round with notable participation from Regeneron, Eli Lilly, and Amgen (businesswire.com ↗). The company develops programmable mRNA therapies for cancer treatment. The funds will advance STX-001 into later clinical phases, while a second candidate, STX-003, is expected to enter phase 1 next year.

E. Toward Hybrid Strategies

Analysis of investments in 2025 reveals that these strategic pathways are not as distinct as they may appear. Many pharmaceutical players are adopting a hybrid approach, combining multiple modalities rather than committing to a single strategy.

Novartis, AbbVie, and Eli Lilly exemplify this trend with a multidimensional strategy: major acquisitions to rapidly integrate mature technologies and advanced pipelines, coupled with extensive collaborations to share risk across early-stage programs (Tables 1 and 2). This approach secures immediate assets while maintaining financial flexibility for exploratory projects.

This convergence toward hybrid strategies can be explained by several factors. Acquisitions accelerate the integration of advanced clinical assets and reduce time to market-an essential element in the technological race. Collaborations diversify risk and provide access to multiple platforms without mobilizing substantial capital. Internal development ensures control over strategic technologies and preserves long-term independence.

III. Overview of Invested RNA Technologies

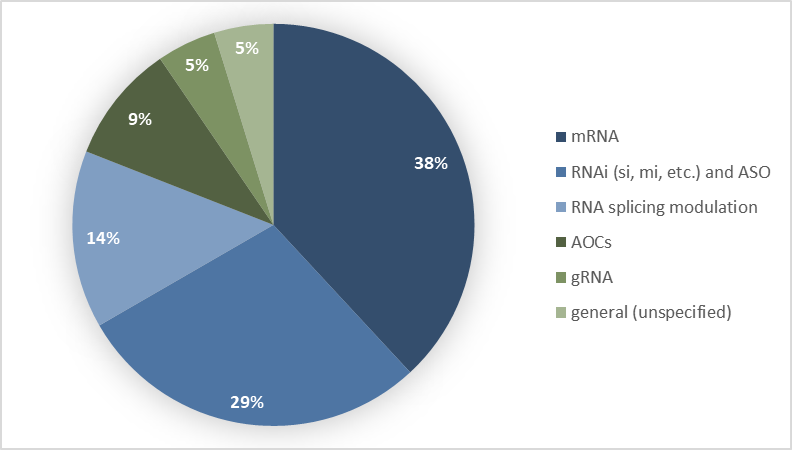

Analysis of 2025 investments reveals that four major categories of RNA technologies account for the bulk of industrial interest: mRNA, RNA interference (RNAi), splicing-modulating RNAs, and antibody–oligonucleotide conjugates (AOCs). However, this distribution is not uniform.

Figure 1: Distribution of investments by ARN technology family

A. Distribution of Investments by RNA Type

Messenger RNAs (including circular mRNA and self-replicating RNA) account for 38% of identified investments (Figure 1). This category benefits from the momentum generated by COVID-19 vaccines, which demonstrated the clinical and industrial viability of this approach. Circular mRNAs, such as those developed by Orbital Therapeutics (Bristol Myers Squibb), offer significant advantages in terms of stability and duration of expression, enabling therapeutic applications that require sustained protein expression (Table 2). Self-replicating mRNAs, such as those developed by Replicate Bioscience, are a class of mRNA molecules designed to replicate within host cells without producing viral particles, thereby enhancing protein expression (Table 1).

RNA interference (RNAi) technologies (including siRNAs, microRNAs, and other inhibitory RNAs) and antisense oligonucleotides (ASOs) account for 29% of investments. These technologies, which are more mature than mRNA-based approaches, have already demonstrated clinical efficacy through several approved therapies, such as Patisiran (nejm.org ↗), the first siRNA therapeutic to receive FDA approval on August 10, 2018, indicated for the treatment of adult patients with polyneuropathy caused by hereditary transthyretin-mediated amyloidosis, and Givosiran (nejm.org ↗), the second RNAi therapeutic approved by the FDA in November 2019 for the treatment of acute hepatic porphyria (fda.gov ↗). Since the approval of Patisiran in 2018, seven siRNA-based therapies have been commercialized (mdpi.com ↗). Sustained interest in these modalities is driven by their ability to target mRNAs encoding proteins considered “undruggable” by conventional therapeutic approaches.

Splicing-modulating RNAs account for 14% of investments. These technologies, including Rznomics’ trans-splicing ribozymes, enable the correction or modification of pre-mRNA splicing, offering therapeutic opportunities for genetic diseases caused by splicing-related mutations.

Antibody–oligonucleotide conjugates (AOCs) represent 9% of investments, a niche almost exclusively occupied by Novartis following its acquisition of Avidity Biosciences and its agreement with Arrowhead Pharmaceuticals. This technology combines the targeting specificity of antibodies with the regulatory activity of oligonucleotides, enabling precise tissue delivery of RNA therapies, particularly promising for neuromuscular disorders.

Guide RNAs (gRNAs) account for 5% of investments. In 2025, Eli Lilly appears to be the sole investor in this area through its acquisition of Verve Therapeutics. The acquired technology is based on the combination of an adenine base editor and an gRNA directed at a target gene, PCSK9 in the case of the VERVE-102 therapy. The entire system is encapsulated in a lipid nanoparticle (LNP) engineered to access liver cells by binding to the LDL receptor (low-density lipoprotein receptor) or the ASGPR (asialoglycoprotein receptor).

B. Technological Strategies of Industry Leaders

The analysis of 2025 investments reveals distinct technological strategies depending on the company:

Eli Lilly focuses its investments on RNAi technologies. Of its four deals, three directly involve RNAi: an RNAi platform with City Therapeutics, the development of antisense RNAi oligonucleotides with Olix Therapeutics, and access to AI-designed oligonucleotide therapies via Creyon Bio (Table 1). This focus likely reflects a desire to master a mature technology applicable to multiple targets in metabolic diseases.

Novartis demonstrates a more diversified approach. The acquisition of Regulus Therapeutics brings an inhibitory microRNA oligonucleotide, miR-17 Farabursen, for kidney diseases, while the collaboration with Argo Biopharmaceutical concerns an siRNA, ANGPTL3 (BW-00112), for dyslipidemia treatment. Notably, Novartis is the only major player to invest heavily in AOCs through the acquisition of Avidity Biosciences and the agreement with Arrowhead Pharmaceuticals for AOCs targeting neuromuscular disorders. This technological diversification suggests a broad coverage strategy to avoid reliance on a single modality.

AbbVie takes a balanced approach with the acquisition of mRNA technology, Capstan’s CPTX2309 for autoimmune diseases, and two siRNA agreements with ADARx Pharmaceuticals and Soufflé, covering several therapeutic areas.

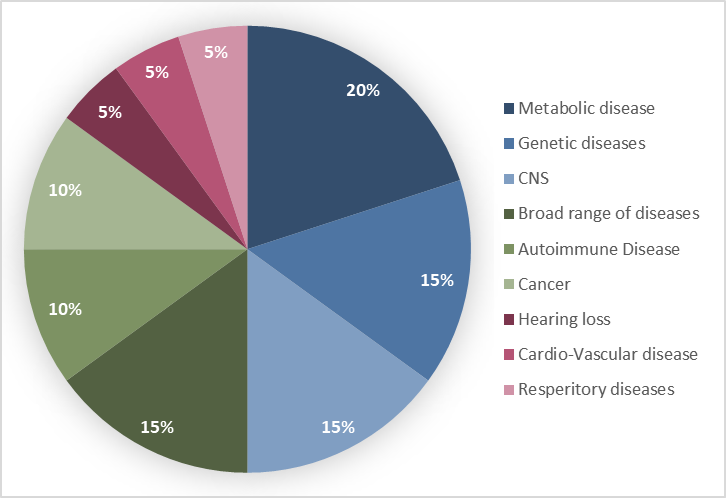

IV. Targeted Therapeutic Areas: Broad Coverage

Investments in RNA technologies in 2025 span a remarkably wide therapeutic spectrum, confirming the versatility of this approach.

Figure 2: Distribution of investments by therapeutic area

A. Metabolic Diseases and Nervous System Disorders: Investment Priorities

Investments are particularly focused on metabolic diseases and nervous system disorders, highlighting the strategic importance of these therapeutic areas. This priority reflects both the historical expertise of certain key players and advances in RNA delivery to the central nervous system.

In the metabolic domain, developments notably target metabolic steatohepatitis, which is an accumulation of triglycerides within liver cells that can progress to hepatitis (Figure 2). They also address other metabolic diseases such as obesity and diabetes.

In the field of nervous system disorders, investments in RNA-based therapies focus in particular on Parkinson’s disease and other synucleinopathies. The latter comprise a group of neurodegenerative diseases characterized by the abnormal accumulation of synuclein protein aggregates in neurons, nerve fibers, or glial cells (Figure 2). Other central nervous system conditions are also targeted, including certain neurological disorders and hereditary hearing loss, further emphasizing the strategic significance of these therapeutic areas.

B. From Rare Diseases to Cancer: Rapid Diversification of RNA Applications

Beyond these areas, the potential of RNA-based therapies extends across a wide range of other pathologies.

In the field of genetic diseases, recent investments in RNA technologies target several therapeutic areas with high unmet medical needs. Identified priorities include certain severe neuromuscular diseases, such as type 1 myotonic dystrophy, a rare and progressive disorder with no disease-modifying treatment; facioscapulohumeral muscular dystrophy, a rare hereditary disease-causing irreversible loss of muscle function and progressive disability; and Duchenne muscular dystrophy, a severe pediatric disease associated with rapid muscle degeneration and reduced life expectancy (Figure 2). Investments in this area also cover non-neuromuscular genetic disorders, notably autosomal dominant polycystic kidney disease, the leading hereditary cause of kidney failure worldwide.

Oncology and autoimmune diseases also constitute major strategic axes for investments in RNA-based therapies (Figure 2). In oncology, developments focus on programmable mRNAs designed to enhance or direct the immune response within experimental anticancer immunotherapies. For autoimmune diseases, initiatives target B cell-mediated pathologies, using conventional or circular mRNAs combined with lipid nanoparticles to enable in vivo CAR-T therapies. These approaches allow the expression of a chimeric receptor in T lymphocytes, enabling targeting of CD19 to eliminate autoreactive B cells and reset the immune system.

Finally, the cardiovascular sector also represents a strategic therapeutic area, with targeted investments in RNAi development for conditions such as dyslipidemia (Figure 2). This chronic disease is characterized by abnormal lipid levels, such as cholesterol, in the blood, and is a major risk factor for cardiovascular disease.

This therapeutic diversification illustrates the growing maturity of RNA technologies, now capable of addressing a wide range of pathologies with mechanisms of action tailored to each indication.

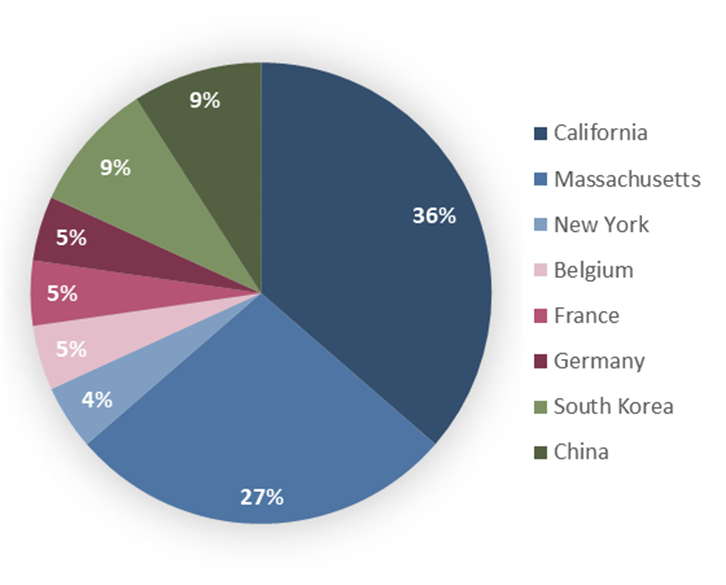

V. Geography of Innovation: Challenging U.S. Dominance

The analysis of the geographic origins of biotechnology companies receiving investments in 2025 reveals a marked geographic concentration but also signals of increasing diversification. It should be noted that this mapping reflects the location of RNA-specialized biotech companies that were acquired or funded by major pharmaceutical companies in 2025, not the location of the investing pharmaceutical groups themselves.

Figure 3: Distribution of the number of selected investments according to the geography of innovation

A. The United States: The Epicenter of RNA Innovation

The United States overwhelmingly dominates, accounting for 67% of biotech companies that received funding or were acquired, with two hubs standing out within this leadership. California emerges as the undisputed leader in therapeutic RNA innovation, representing 36% of all funded or acquired companies (Figure 3). San Diego and the Bay Area host several major players such as Capstan Therapeutics, Regulus Therapeutics, Avidity Biosciences, Replicate Bioscience, ADARx Pharmaceuticals, Nosis Biosciences, and Creyon Bio. This ecosystem benefits from proximity to top universities (Stanford, UC San Diego, UC Berkeley), a dense network of biotech-focused venture capital, and a remarkable concentration of scientific and entrepreneurial talent.

Massachusetts is the second major U.S. hub, representing 27% of the total, centered around Boston and Cambridge (Figure 3). This region hosts established players like Moderna, as well as numerous innovative companies such as Orbital Therapeutics (Bristol Myers Squibb), City Therapeutics, and Skyhawk Therapeutics. The ecosystem benefits from proximity to MIT, Harvard, and their affiliated laboratories, creating a virtuous cycle between academic research and industrial applications. New York also emerges as a secondary hub, with several promising startups.

B. Europe: Emerging National Champions

Europe accounts for 15% of companies that received investments or were acquired, with three countries particularly active in 2025 (Figure 3). Germany maintains its position as the European leader thanks to mRNA pioneers such as BioNTech and CureVac. Even after BioNTech’s acquisition of CureVac, the country retains a dynamic ecosystem with strong government support.

France, although absent from this wave of acquisitions and collaborations in 2025, strengthens its position through Sanofi’s massive investment since 2022 in its Marcy-l’Étoile center of excellence. This strategy of technological independence aims to create a complete mRNA value chain within France.

Belgium also contributes with Etherna, which signed an agreement with the U.S. biotech Dropshot Therapeutics, demonstrating the vitality of the Belgian biotech scene.

C. Asia: Rising Power

Asia accounts for 18% of investments, a significant share that reflects the emergence of new innovation hubs in the region (Figure 3). South Korea stands out in particular, with Rznomics and Olix Therapeutics attracting Eli Lilly, illustrating the growing maturity of Korean biotech research and development.

China, although less visible in this 2025 investment wave, is rapidly expanding its capabilities in therapeutic RNA, notably with Argo Biopharmaceutical and SangeneBio, both of which signed agreements with Novartis and Eli Lilly, respectively, signaling their gradual integration into the global RNA therapy innovation ecosystem.

D. Government Initiatives: A Global Race

Beyond private investments, several governments launched RNA research support programs in 2025. Singapore announced a SGD 130 million (~USD 97 million) RNA biology research program to expand therapeutic applications and strengthen its position as an Asian biotech hub (miragenews.com ↗).

In Saudi Arabia, the government is actively supporting the growth of the RNA therapy market through various initiatives aimed at fostering innovation and scientific collaboration (marketsandata.com ↗).

The state of New York will invest USD 50 million to expand the RNA Institute at the State University of New York (usenergyindustrynews.com ↗). This funding, included in SUNY’s 2025-2026 investment budget, will increase the capacity of the life sciences research facility to advance research, training, and the development of the Institute’s world-class workforce, including its work using artificial intelligence to guide innovative drug discovery approaches.

In Australia, the New South Wales government confirmed that construction of its dedicated RNA research and manufacturing center, costing AUD 96 million, is progressing as planned and is expected to be completed in 2026, thereby strengthening the state’s sovereign manufacturing capabilities in RNA therapies (nationaltribune.com ↗).

Quebec also stands out with two major initiatives that structure its RNA therapy ecosystem. The first, AReNA, is a Quebec hub of excellence supported by a provincial investment of CAD 20.3 million. AReNA brings together all provincial stakeholders, researchers, companies, research centers, and institutions, with the goal of accelerating collaborations and strengthening Quebec’s international competitiveness in this field. Beyond its coordination role, AReNA actively contributes to innovation funding, biomanufacturing, technology transfer, and training. The organization also engages the scientific and industrial community through conferences and networking events that foster partnerships between academia and industry. Through this integrated approach, Quebec aims to become a recognized international hub for RNA therapy innovation.

The second initiative, D2R (DNA to RNA), is a major global research program led by McGill University and endowed with an exceptional funding of CAD 165 million. The program aims to leverage genomics to design innovative RNA therapies capable of treating previously incurable diseases. D2R is distinguished by its multidisciplinary approach, combining RNA biology, genomics, bioinformatics, and biomanufacturing to develop a new generation of genomics-guided medicines. The targeted applications span a broad therapeutic spectrum, including infectious diseases, oncology, and rare diseases. This initiative demonstrates Quebec’s ability to undertake ambitious research projects and secure substantial funding to position its institutions at the forefront of global biomedical innovation.

VI. Conclusion: A Revolution Underway, Challenges Ahead

The year 2025 marks a massive commitment by pharmaceutical and biotechnology giants to RNA therapeutics. Over USD 35 billion in investments have been identified, likely more if undisclosed transactions are included.

Success Factors

Beyond vaccines for respiratory diseases, positive clinical data are accumulating, such as the Phase 3 trials of Fitusiran (sanofi.com ↗), an siRNA for the treatment of hemophilia, and mRNA-4157 (trials.modernatx.com ↗), an mRNA combined with pembrolizumab for non-small cell lung cancer. Advances in targeted RNA delivery, exemplified by antibody-oligonucleotide conjugates, are opening the way to applications in previously hard-to-reach tissues. Artificial intelligence is also revolutionizing oligonucleotide design, as demonstrated by Creyon Bio’s platform, significantly reducing development timelines

Winning Strategies

The players who will succeed in this new era will be those able to combine multiple complementary approaches, as illustrated by the strategies deployed by sector leaders in 2025. Technological diversification also appears crucial: relying solely on mRNA or RNAi could be limiting given the diversity of therapeutic challenges. Companies will also need to develop robust industrial capabilities, as large-scale therapeutic RNA production remains a technical challenge requiring substantial infrastructure investment.

A Historic Window of Opportunity

Government initiatives in Singapore, Quebec, Saudi Arabia, and Australia reflect a global awareness: RNA technologies have become a matter of health sovereignty and economic competitiveness.

For patients, this revolution could translate into previously unimaginable treatments: single-dose therapies replacing lifelong treatments, personalized vaccines targeting their specific cancer, or genetic corrections for currently incurable diseases. The challenge will be to turn this scientific promise into accessible clinical reality.

If current investments bear fruit, we could witness in the next five to ten years the approval of a wave of revolutionary RNA therapies. The question is no longer whether RNA technologies will transform medicine, but how quickly this transformation will occur and who will benefit first.

One thing is certain: the pharmaceutical industry has irreversibly entered the RNA era. The USD 35 billion invested in 2025 is not a speculative bubble, but a reflection of a deep conviction that we have entered a new therapeutic era. And as with monoclonal antibodies thirty years ago, those who hesitate too long risk being permanently left behind.

Abreviations :

AOC: Antibody–oligonucleotide conjugates

gRNA: Guide RNA

RNAi: Interfering RNA

mRNA: Messenger RNA

ASO: Antisense oligonucleotides

CAR: Chimeric antigen receptors

FDA: Food and Drug Administration

LNP: Lipid nanoparticles

siRNA: Small interfering RNA